.gif)

.gif)

With Ethereum moving to PoS following The Merge, a key concern has been the centralization of staked Ether (ETH).

One of the original ideas for blockchains was to enable decentralization. However, economies of scale regarding energy costs and equipment ultimately resulted in large, centralized mining farms and pools. This, among other arguments, leads the discussion towards other technical solutions such as PoS.

However, some have argued that PoS also inherently results in centralization. Many tend to opt for liquid staking or staking via third parties out of convenience, and the market for staking providers is one that also benefits from economies of scale.

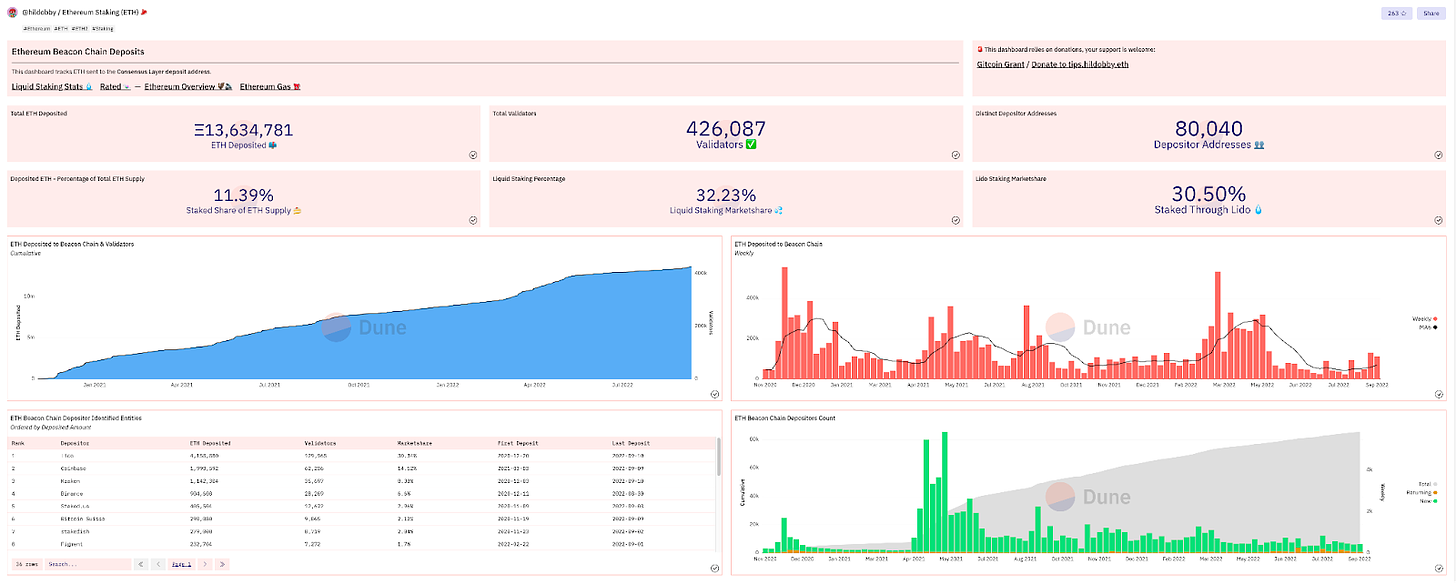

The actual number of unique addresses participating in staking is very high (~80k). However, it is more nuanced when looking at the landscape of intermediary staking service providers that stake the ETH on behalf of their users. Consequently, although the stakers (as in ETH contributors) might be quite diverse, most of the staked ETH and validators could be (indirectly) controlled by a handful of entities or governing bodies.

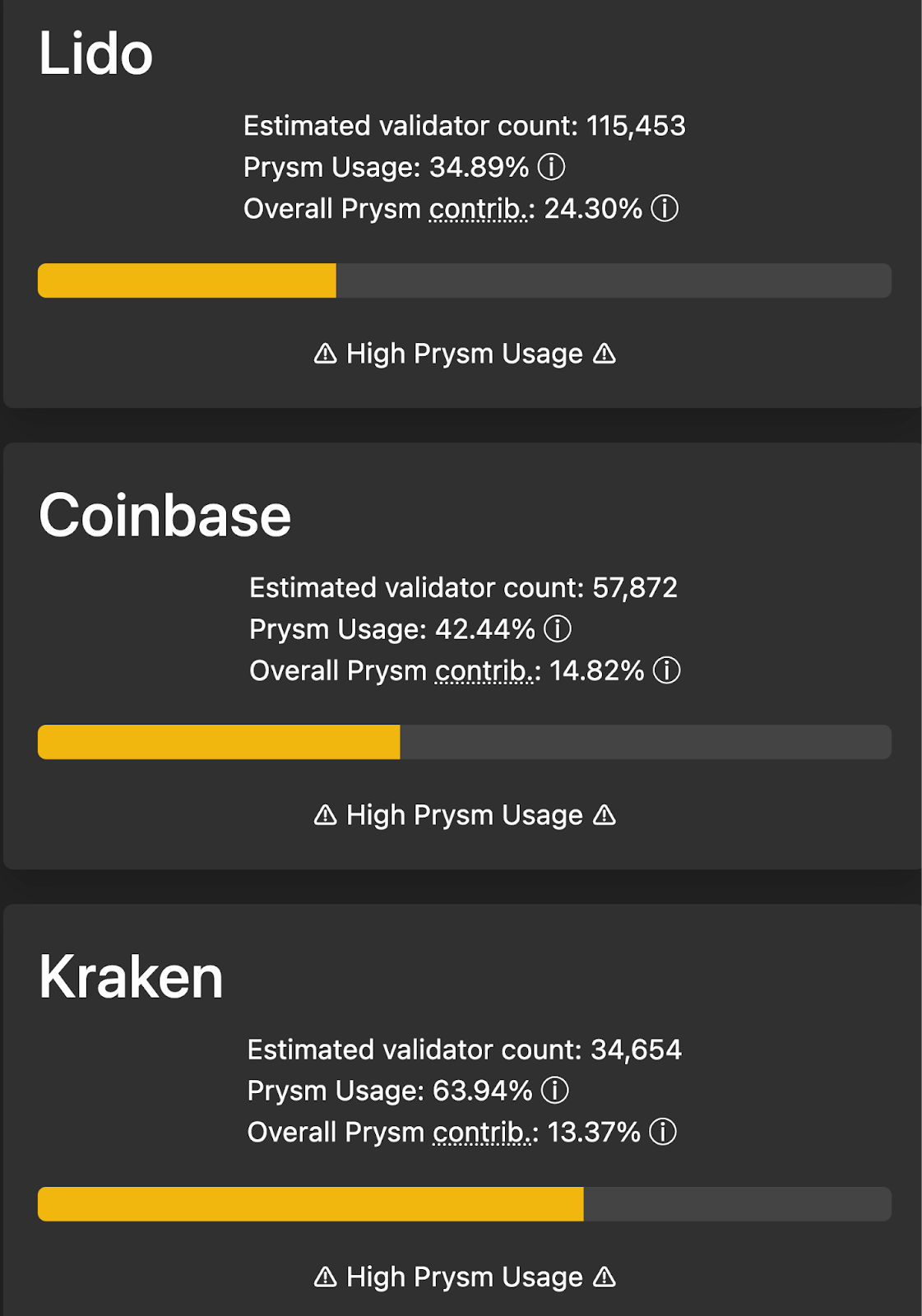

In light of recent events regarding Tornado Cash, many concerns have been raised with the transition to PoS and the implications of the concentrated stake amongst a few actors. Any major validator that acts maliciously toward the network or is targeted directly by regulators could threaten Ethereum’s value proposition as a secure, decentralized, and censorship-resistant infrastructure.

Although they are not technically the same thing, comparing the hash rates of the largest mining pools and staked ETH of the largest staking entities or intermediaries can function as a rough indicator when looking at PoS vs. PoW centralization for Ethereum. At first glance the two seem almost equally (de)centralized at an entity level - the top 3 combining over half and the top 5 around two-thirds of the hash rate or stake respectively:

Recent discussions:

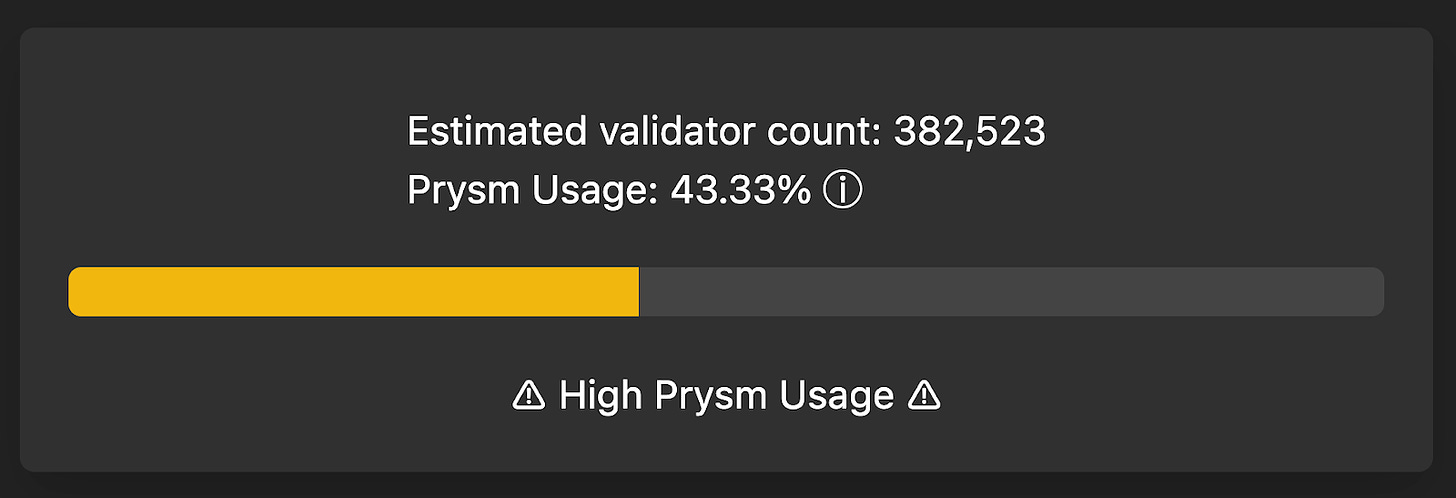

There has been an increase in concern regarding the potential for censorship following the US government sanctioning the Tornado Cash protocol (through OFAC) on August 8th 2022. This resulted in a number of protocols blocking addresses that had interacted with Tornado Cash and raised some valid concerns regarding the assumptions around permissionless participation on Ethereum. Despite a number of frontends censoring addresses, they are still accessible by interacting with their permissionless contracts. However, there is concern that if Ethereum itself becomes sufficiently centralized, certain users could be censored which would invalidate its core value proposition of being a decentralized and open infrastructure. This makes assessing the implications of The Merge and a deeper look into the top staking entities as important as ever.

| PoW: Mining pool | % Hashrate | PoS: Staking entity | % Staked ETH |

|---|---|---|---|

| Ethermine | 28.80% | Lido | 31.00% |

| f2pool2 | 14.80% | Coinbase | 15.00% |

| Hiveon Pool | 9.80% | Kraken | 8.38% |

| 2miners | 7.60% | Binance | 6.64% |

| Flexpool.io | 4.70% | Staked.us | 2.98% |

| Total | 65.70% | 64.00% |

According to Dune Analytics, by September 10, there is more than 13 million ETH deposited on Beacon Chain. 30% of the market share is taken up by Lido, a liquid staking service provider, while the big central exchanges, Coinbase, Kraken, Binance are among the other biggest depositors, taking up 14.5%, 8.3% and 6.6% market share.

Source:

https://research.nansen.ai/article/174/the-merge-a-deep-dive-with-nansen

https://banklessdao.substack.com/p/the-merge-part-ii-defi-download